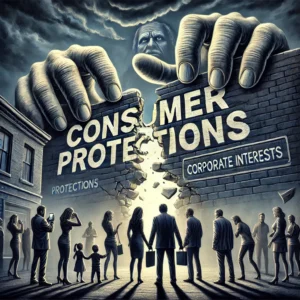

The current administration has stopped the Consumer Financial Protection Bureau (CFPB) from protecting consumers and other small businesses against abusive financial practices. The consequences of dismantling the CFPB could be far-reaching, and we rely on their protections to navigate an often precarious financial system.

The current administration has stopped the Consumer Financial Protection Bureau (CFPB) from protecting consumers and other small businesses against abusive financial practices. The consequences of dismantling the CFPB could be far-reaching, and we rely on their protections to navigate an often precarious financial system.

Why the CFPB Matters

Since its creation over 15 years ago, the CFPB has played a vital role in holding financial institutions accountable. The agency was born out of the need to prevent the kinds of financial abuses that led to widespread job loss, foreclosures, and other economic devastations. Without the CFPB, financial companies may once again be free to engage in unfair and deceptive practices, putting millions of Americans at risk.

The CFPB’s work is to ensure that consumers are not subjected to predatory lending, excessive fees, or other harmful practices by large financial institutions.

Its oversight has helped recover $21 billion for over 200 million consumers, assisting people who credit bureaus and unfair mortgage practices negatively impacted.

What’s Happening?

Recent developments are alarming. On February 7, 2025, the CFPB Director Rohit Chopra was fired, which has raised significant concerns. Acting Director Russell Vought’s declaration that he would request zero funding is concerning unless he has a plan for how to manage the agency without funding. We heard that unvetted employees of the current administration may compromise sensitive financial data collected from consumers and CFPB.

Elon Musk’s statement on Twitter, “CFPB RIP,” and Vought’s actions seem to signal an effort to undermine the agency that was created to protect consumers from the very types of financial abuses that triggered the Great Recession.

What Might Be at Stake

The potential closure of the CFPB could result in the loss of critical protections for consumers. These include safeguarding sensitive personal information from cyberattacks, protecting consumers from financial fraud, and ensuring that families facing unfair foreclosures have a place to turn for assistance.

The CFPB’s efforts have helped return $5 billion in overdraft fees to struggling families and removing medical debt from credit reports for millions of Americans. However, these efforts could be jeopardized if the administration succeeds in dismantling the agency.

In the legal battles currently underway, where big banks and credit bureaus are attempting to reverse these consumer protections, the CFPB’s inability to defend these rules may lead to harmful consequences for consumers.

How You Can Help: Take Action Today

There is still time to defend the CFPB and ensure that it continues its vital work. Here’s how you might get involved:

- Contact Your Elected Officials: Call or email your representatives to express the importance of keeping the CFPB intact. The agency’s role in protecting consumers from harmful financial practices is essential to maintaining a fair marketplace.

- Join Consumer Advocacy Week (March 10-14): This week provides a chance to meet virtually with lawmakers and advocate for the CFPB’s survival. Your voice can make a difference in ensuring lawmakers understand this agency’s importance.

- Support NCLC’s Efforts: The National Consumer Law Center (NCLC) is working tirelessly to defend the CFPB and ensure it can continue its critical work. Consider donating to their efforts to support legislative outreach and litigation.

- Learn More About the Impact of the CFPB: Read articles and stay informed about the current situation. The work of the CFPB affects millions of families and businesses, and understanding the potential consequences of its dismantling is crucial.

The CFPB is an essential safeguard for consumers in a financial system that often prioritizes profits over fairness. With the current threats to its existence, now is the time to act. By joining efforts with organizations like NCLC, contacting lawmakers, and supporting advocacy initiatives, we can help ensure that the CFPB continues to protect us all from financial harm.

The information provided does not, and is not intended to, constitute legal advice; all information is for general informational purposes only. This information may not constitute the most up-to-date information. Links provided are only for the convenience of the reader, A. Ferraris Law, PLLC and its members do not endorse the contents of the third-party references.

Copyright©2025, A. Ferraris Law, PLLC. All Rights Reserved.